- Published on

What is the risks of USDT

- Reading time

- 4 分钟

- Page view

- -

- Author

- Name

- Yicong

- Github

How USDT works?

- Pegging Mechanism: 1:1 Reserve Backing Reserve System: Tether claims that for every 1 USDT issued, it holds $1 in equivalent assets (including cash, short-term U.S. Treasuries, commercial paper, etc.) in its bank accounts. This reserve system is the core mechanism for maintaining USDT’s 1:1 peg to the U.S. dollar.

Transparency Controversy: Tether has faced criticism for insufficient transparency regarding its reserves. Since 2021, the company has regularly published reserve composition reports, revealing reserves consisting of cash and cash equivalents (~85%), secured loans (~5%), and other assets.

- Issuance and Redemption Mechanisms Issuance Process: Users deposit U.S. dollars through compliant exchanges or Tether partners. Tether then mints an equivalent amount of USDT and sends it to the user’s address.

Redemption Process: Users burn USDT and can apply to Tether to redeem U.S. dollars (typically limited to institutional clients). Tether reduces the circulating supply accordingly.

Multi-Chain Issuance: USDT is issued across multiple blockchains (e.g., Omni, ERC-20, TRC-20) to integrate with different ecosystems. However, cross-chain transfers rely on centralized exchanges.

- Price Stability Mechanisms Arbitrage-Driven Stability: If the market price of USDT deviates from $1, arbitrageurs profit by buying undervalued USDT to redeem for dollars (or vice versa), pushing the price back to the peg.

Supply-Demand Adjustments: Tether adjusts market liquidity by minting or burning USDT. For example, it increases supply during surging demand to suppress premiums.

- Technical Implementation Blockchain Foundations:

Omni Protocol (Bitcoin-based): The original form of USDT, offering high security but slow transaction speeds.

ERC-20 (Ethereum): Supports smart contracts and faster transactions, becoming the dominant standard.

TRC-20 (Tron): Zero fees and high throughput, ideal for high-frequency trading.

Centralized Control: Tether retains authority to freeze addresses, reverse transactions, and enforce compliance, addressing hacks or regulatory requirements.

- Use Cases Trading Medium: Acts as a benchmark pricing unit on crypto exchanges, replacing volatile assets like BTC/ETH.

Safe-Haven Asset: Investors convert holdings to USDT during market turbulence to preserve value.

Cross-Border Payments: Enables low-cost, rapid transfers outside traditional banking systems.

- Risks and Controversies Reserve Risks: Devaluation of reserve assets or a sudden surge in redemptions (a "bank run") could break the peg.

Regulatory Scrutiny: Tether has been fined by U.S. regulators for alleged market manipulation and reserve opacity.

Centralization Risks: Tether’s absolute control over the token has raised trust concerns.

Summary USDT serves as a bridge between fiat and cryptocurrencies through reserve-backed pegging, issuance-redemption arbitrage, and multi-chain support. Despite controversies over its centralized model and transparency issues, USDT remains the dominant stablecoin due to its first-mover advantage and widespread adoption. Users must weigh its convenience against potential risks.

What does USDT really mean to the government and market?

USDT's balance sheet is structured like this: the liability side is the USDT it issues, and the asset side is the U.S. Treasury bonds, companies, Bitcoin, etc. that it holds. So from the balance sheet, USDT has become the same structure as the central bank. Has the stablecoin issuing company become the central bank?

In fact, not only that, let's take a look at the application of stablecoins. Whether it is USDT or USDC, this type of stablecoin has been listed on the official website. Its use is not only from speculation, but also from the establishment of merchant payment ports, and even using stablecoins to pay wages.Because they claim that they can be exchanged with the US dollar 1:1, and many merchants and credit cards accept USDT payments, so stablecoins have entered the circulation field, and they are no different from the US dollar in buying and selling goods.

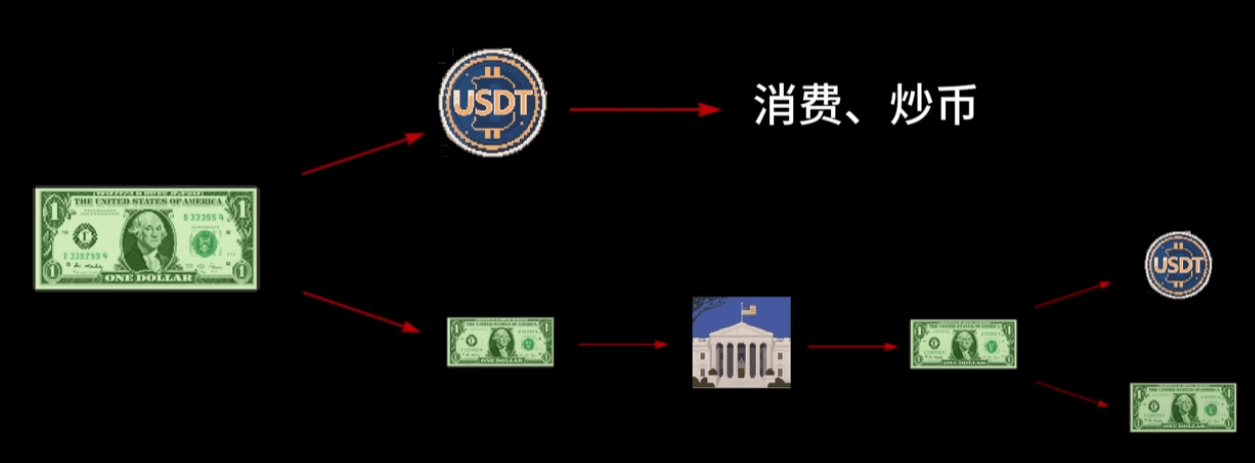

But in fact, let's look at Tether's claim again. Investors give Tether one dollar, and Tether gives investors 1USDT, and at the same time puts this dollar into the reserve. But the one dollar in the reserve is not Instead of lying quietly in the bank account, this dollar is used to buy U.S. Treasury bonds. At the same time, the USDT corresponding to this dollar is still equal to one dollar in actual circulation. Therefore, after investors give Tether one dollar, two equivalent dollars are actually circulated in the market. One dollar is used to buy U.S. Treasury bonds and the other dollar is still in use. This completely violates the logic of the Federal Reserve when the currency was first issued. This is why the current U.S. cabinet is so fascinated by cryptocurrencies. They vigorously promote cryptocurrencies. As long as Americans use stablecoins as the main means of payment, the corresponding deposited dollars can easily buy U.S. Treasury bonds, thereby solving the U.S. debt problem.

At the same time, Trump's cabinet It has gained an opportunity to bypass the Federal Reserve and establish its own central bank. Although stablecoins are still based on the US dollar, the US dollar can be easily split into two as long as it enters the stablecoin system. According to the Trump administration's strong demand for relaxing cryptocurrency regulation, it is possible to split it into three or four parts through operations. In other words, one dollar enters the stablecoin system. The USDT that Tether actually enters the market may end up being two USDTs, or even more. The US government can achieve substantial quantitative easing through stablecoins. And due to the natural connection and closeness of cryptocurrencies, the prices of other cryptocurrencies such as Bitcoin will be pushed up, which is beneficial to Trump's interest group. Profit.

What is weak point of this loop?

But in the process of exchanging USDT back to USD, this process is the process of currency elimination. For example, if someone finds Tether to exchange USDT back to USD, then 1 USDT is exchanged for 1 USD, and Tether needs to sell 1 USD of Treasury bonds to exchange for this USD. The final result is that 1 USDT and 1 USD are reduced in the market at the same time, and only 1 USD is exchanged. This will cause a double decline in the US debt and cryptocurrency markets, so for the Trump administration, it is necessary to increase the price of Bitcoin.

Potential Result

In the end, the USDT mechanism will collapse when digital currencies fall on a large scale and drag down the US debt market. Its essence is a digital currency replica of the subprime mortgage crisis.